Early Adoption Guidance

Updated 20 December 2024

Please note: The Tier 4 Combined Annual Return form is currently unavailable. Tier 4 charities can still file their annual returns using the standard Annual Return form and attaching their Performance Report separately. See below for these forms.

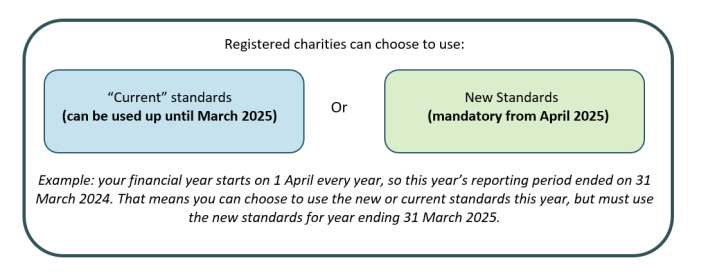

In May 2023, the External Reporting Board (XRB) published new reporting standards for registered charities reporting at Tier 3 and Tier 4. These new standards will become mandatory from next year (2025), but charities can choose to start using them now for any reporting periods that end after 15 June 2023.

Registered charities can choose to use:

How to choose

No matter what your charity’s situation is, the choice you make will depend on what’s best and easiest for your charity, now and in the future.

First time reporting

If it’s your first-time reporting, we recommend that you use the new reporting standards. This will make it much easier for your charity to continue reporting, as you won’t have to learn new standards after just one year.

Check with your accountant (if you have one)

If your charity has an accountant, your first step is to speak with them. They’ll know what’s required, what’s best for your organisation, and what will make your future reporting easier.

Have a look at the Performance Report templates

We recommend you start by having a look at the new performance report template. Download a copy of them from the XRB website here:

These will show you what information is required in the new standards. You will see it is very similar to what you are already preparing, but a little easier to prepare and with some slightly different categories in the financial sections.

Compare the new template with your financial records, and decide if you have all the information you need to complete the new standards. If you do, feel free to start using the new standards early!

If you don’t have the information needed for the new standards this year, that’s ok. Just make a note of what’s required, and make sure you’re collecting and preparing that information for your next annual return.

And don’t forget, no matter what standards you choose to use this year, you have to start using the new reporting standards for any reporting period that began on or after 1 April 2024!

Choosing the right Annual Return

Regardless of which standards you use for your performance report this year, you’ll also need to complete your annual return using the same reporting standard.

The easiest way to complete your annual return is by logging in to your dashboard and clicking the “Create Annual Return” button at the top of the page. Then you can confirm the year you’re filing for, and select which standards you’re using.

Next to “Select the Annual Return form to complete”, pick one of these two options:

- New Annual Return Form – pick this if you’ve chosen to report using the new standards

- Current Annual Return Form – pick this if you are still using the current standards